Netflix

Netflix should not be thought of as a streaming business. Streaming is not the business model, it’s the source of data.

Hollywood is similar to Silicon Valley. It’s an entrepreneurial ecosystem with an equivalent of venture capital — studios.

VCs have tried using data to improve their investment decisions. They had moderate success. The problem is that it’s difficult to collect comparable startup data sets.

Netflix has it all for content.

It knows exactly who is watching what, when, and for how long. They track cast and genres. Traditional producers don’t come close to that level of insight.

Data allows Netflix to predict the popularity of content more precisely.

It doesn’t mean they are right every time. But they do have a higher rate of successful bets. And this translates into better unit economics.

Kissmetrics published an analysis that gives an idea of how impactful this is:

“When a network green lights a show, there’s a 35% chance it succeeds and a 65% chance it gets canceled. At the time of this writing, Netflix has 7 TV shows, of which 5 have been renewed for another season. If this rate can continue for years, the Netflix success rate will be about 70%.”

Netflix has become an investment vehicle with elaborate data collection operations.

The content production business (tv, movies, standup specials, etc.) is larger than cable. Streaming has eaten cable. Netflix could extract rent from its streaming business. They instead use it to generate data and dominate content production.

Netflix’s actions seem to confirm this theory.

The content they are focused on is the type that benefits the most from large troves of data. Netflix states on its website:

“We are not a generic “video” company that streams all types of video such as news, user-generated, sports, porn, music video, gaming, and reality. We are a movie and TV series entertainment network.”

New York Times, in its piece on Netflix, quoted an investment bank analyst, Michael Pachter, saying:

““Netflix,” Pachter concluded, “is caught in an arms race they invented.” He compared Netflix to a rat racing on a wheel, staying ahead only by going faster and faster and spending more and more: As its costs continue to go up, it needs to constantly generate more subscribers to stay ahead of others.”

What this view is missing is that Netflix is playing a long game. The content it is producing is going to pay a dividend over time. It is reasonable to grow the subscriber at break-even or loss. It seems this is what they are doing.

This strategy pays off two-fold.

First, Netflix can gather more data. This means better investment decisions. Second, returns on the content that has already been produced improve. It has already been paid for. Now it gains a new audience.

The content that Netflix owns can also be monetized outside of its subscription service. Reed Hastings admitted that this is an option in a letter to shareholders (April 17, 2017):

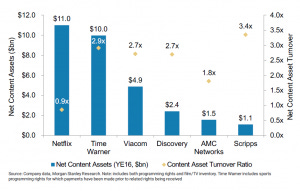

It seems like Netflix is getting less out of its content than other companies. This comparison is missing accounting for the value of data that is leveraged to lower the cost of buying new content. Source: Investopedia

First, Netflix can gather more data. This means better investment decisions. Second, returns on the content that has already been produced improve. It has already been paid for. Now it gains a new audience.

The content that Netflix owns can also be monetized outside of its subscription service. Reed Hastings admitted that this is an option in a letter to shareholders (April 17, 2017):

“Since our members are funding these films, they should be the first to see them. But we are also open to supporting the large theater chains.”

Innovators Dilemma

Netflix is disrupting content production the way Clayton Christensen described it in Innovator’s Dilemma. First, they dominated categories that were not attractive to established players.

Standup specials are a good example. Netflix owns this category. And it didn’t have to fight for it. It’s not the type of content big studios were interested in. Now Netflix is expanding its territory with star-studded movies.

Reed Hastings told investors that Netflix’s main competitor is sleep. The argument was that there is space for more than one streaming service.

And that’s true for now.

Amazon

Jeff Bezos seems to think along the same lines. He also said that there is space for more than one streaming service.

Bezos was asked why Amazon Video is not on all devices. He explained that having their player was not possible or too expensive.

This is telling. It’s reasonable to assume that Amazon wants to collect viewership data. They are also making significant investments in content.

Netflix is still doing better. It has more experience and has accumulated more data. However, it seems plausible that Amazon can be a threat to Netflix.

It is the only entity I can think of that may be able to get better unit economics. All things equal (subscribers, pricing, content bets), Amazon makes more money. Amazon Video is bundled with Amazon Prime, so it drives overall sales.

Margins

Capital flows where it can get the highest returns. With better unit economics Netflix and Amazon can raise enough money to put old players out of business.

Then they will have to compete with each other, not over subscribers, but the content. This will drive the prices up and the margins down.

Amazon will likely try to take over Netflix at some point in the future. It might have an advantage in unit economics and can afford to bleed its rivals on margins until they agree to sell.

This would not be the first time it happened.